While most businesses today offer the option of card payments, there are a handful of businesses that still have to get onto the credit card payment bandwagon. If your business is one such business that is still going old school and accepting only cash payments, it’s time you changed things around. If you have a fixed customer base and are happy and satisfied with the sales you’re getting currently, then you probably don’t need to. However, if you’re finding them your sales are dwindling and you need to up your game, then maybe its time you introduced the card processing option. Let’s not discuss exactly when you need to start accepting card payments:

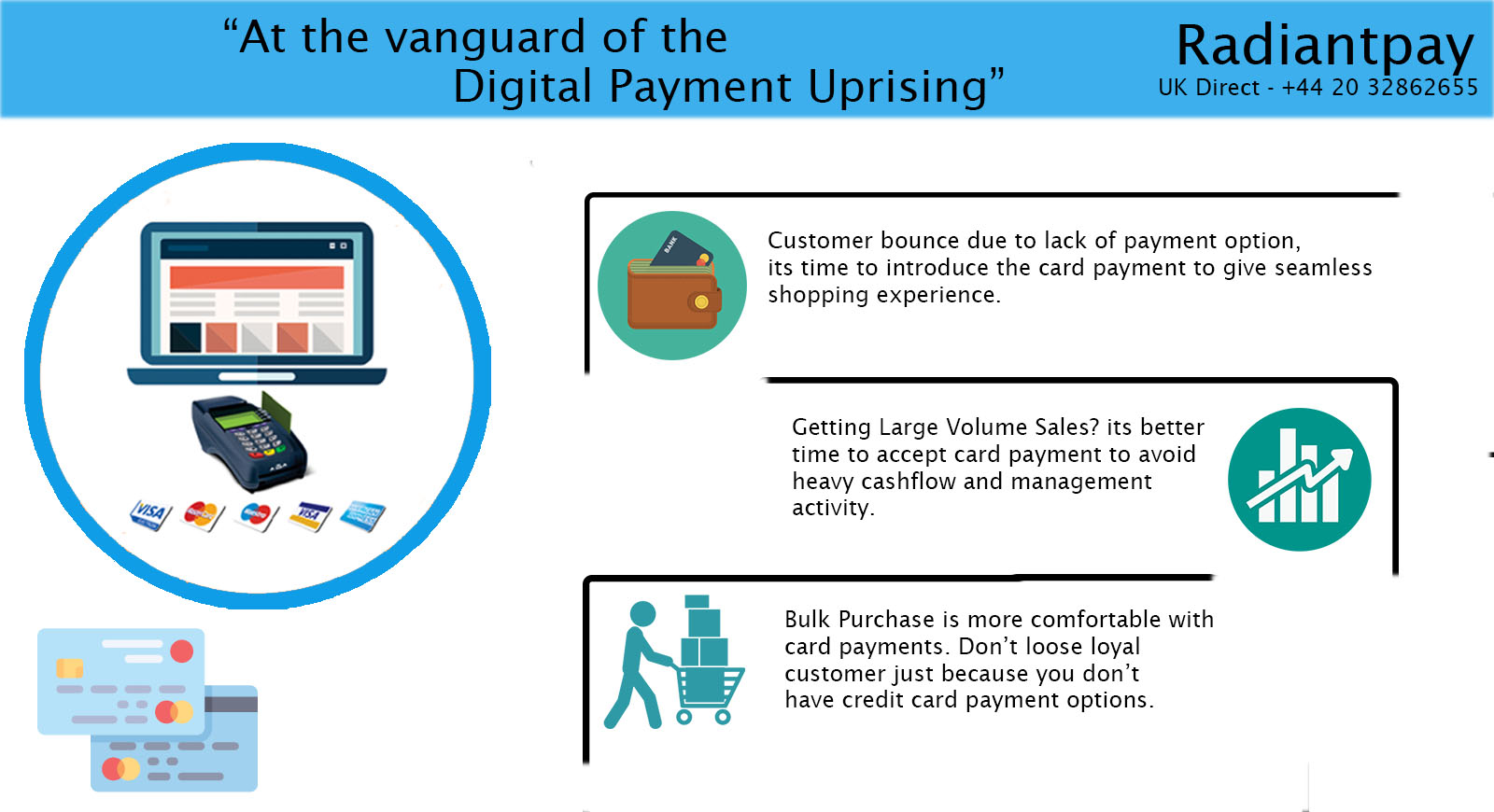

- When you find that customers from other countries and cities are interested in your products, but are unable to purchase them due to lack of payment options, it’s time you introduced the option of credit card payments.

- If you’re beginning to lose old customers because of state of the art modern stores that offer credit card payment options, it is the time that you started offering your customers credit card payment options.

- When you want larger volumes in sales, it is always a better option to provide card payment processing. Some customers have limited cash with them and are more comfortable making bulk purchases with credit cards. You don’t want to end up losing loyal customers just because you don’t have credit card payment options.

Things to Take Into Consideration When Choosing a Credit Card Processor

When selecting a credit card processor, make sure that you opt for a service provider who charges affordable service costs for payment processing. You don’t want to end up using up a chunk of money that you made to pay the service charges of the card processor. Also, make sure that the card processor offers the option EMV chip readers for the safety of your transactions and to prevent fraud.