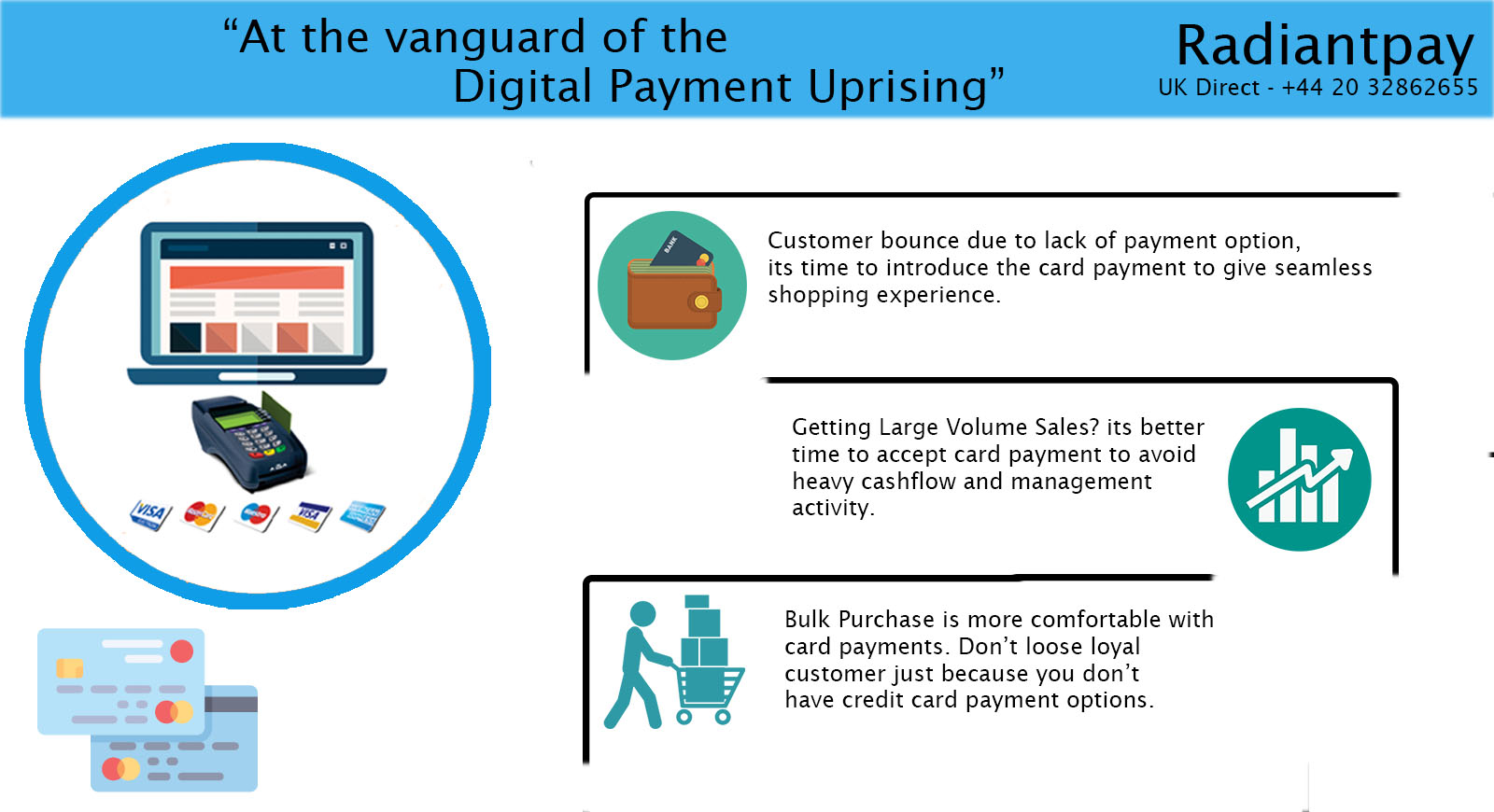

Plastic money, along with mobile payment solutions have become great tools of our day to day. Are you going to travel and besides the cash in the local currency, do you want to go with the peace of mind to be able to pay or get more if you need it? Your online card processing solution is the best option. Have you forgotten the wallet? Nothing happens. You can pay with your smart phone in a lot of places. These are just some of the solutions of your day to day that you can cover. But surely you want to know in depth the advantages and disadvantages of online card processing solution to get the most out of them as a good smart consumer.

Advantages of credit and debit cards: all the details

Probably, when it comes to understanding the advantages of credit and debit cards, the first thing to know is exactly how each one works. Radiant Pay is one of well know credit card solution provider. To know more about its services browse the site http://radiantpay.com/creditcard.html

The credit cards payment solutions are like a credit that the bank grants you. For example, if you make an online purchase at Amazon, it is the entity that advances the payment money to the necessary store and then you return it to your bank within the agreed period. Depending on the chosen modality, you will pay the amount at the end of the month, with a fixed amount or in a specific number of monthly payments by online card processing solution, the interest to pay depends on each entity, but as a general rule if the modality is “payment at the end of the month” there is usually something else, if, for example, you use it to extract cash at an ATM or use another form of deferment.

The debit card works differently. In fact, the same purchase you pay automatically with the money available in your account.

The advisable thing is to have both, since you can use them adapting them to your specific needs. This will give you more flexibility and greater financial freedom.