All the world’s trading practices seem to be shifted online gradually. As they didn’t arrive alone, thus came with the urgent need to search for a proper, appropriate, safe, and click away from an easy mode of payment solution, while purchasing online. This online payment solution is like the backbone for almost entire ecommerce products and service providers.

We can list the best payment solutions, for all the low and high-risk ecommerce businesses working today, or are in the need to get payment solutions, because they are worth performing better online businesses for the betterment of potential buyers online. We can get the explanation and get informed of the different aspects of services provided by any digital payment solution providers.

Some of the payment solutions which are most preferred by ecommerce companies are

- Payment solutions for Credit card and Debit cards processing

- Efficient payment Gateway solutions

- Merchant Accounts for easy transections

- ACH & check to process

- Online banking

- Opening of offshore Merchant accounts

- Specialized in crypto currency Payment solutions

What is an Online Payment Solution provider, and how does it impact your ecommerce well-being?

An online payment service provider is you can say, the agency in between the traders and online buyers, offering payment services, consultation with online merchants, and offering more updated secure transaction methods. More or less it connects buyers with online merchants by easy transactions and timely delivery of stuff and services responsibly.

How to deliver as Payment Service Agency?

What is the expectation?

What are the new technology advancement and there easy marketing is all the working arena of a Payment service provider? First, to last all services are elaborated under

Payment solution for credit cards and debit card processing is a must to cater. As, we all know that in present-day marketing equations, the banks are issuing Credit cards and debit cards to buyers, and are used as the tool to purchase online, and that service can be reached 24 by 7. That’s why the processing agency is readily giving the software which is attached to the web, for payment acceptance.

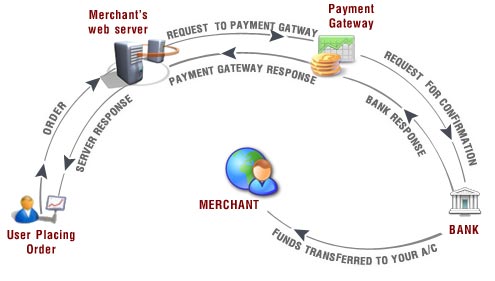

Payment Gateway solutions are those services related to payment online, as a software, a payment gateway can be termed as a tool given on the website for the security of banking data, and forwarding the payment request to the bank, and gains an approval with transparency.

Offshore Merchant Accounts enables the ecommerce business the excess to the global market oversea. They allow them to do oversea trading, accepting the foreign currency, on low taxation. These Offshore Merchant accounts help to collect the huge some and frequent transaction without any hiccups, which are mostly opened by Payment solution providers like the Radiant Pay based in London.

High-Risk Processing, some ecommerce businesses fall in the category of High-risk business, whose order and transaction need some extra care. As these categories’ like Adult Industry, tobacco sale, Casino and Gaming Industry, and the travel industry are just some examples, which is handled with some unique terms and conditions in the International Market.

There are some facilities which are given by experts of online payment solutions like Radiant Pay, for the easy transaction of the fund, although High-Risk in nature.

ACH (Automated Clearing House) and check clearing facility is also a very innovative form of digital payment model, in which the fund is cleared in a scheduled, timely cleared with an automated process, it’s a fund clearing system with e payment and electronically debit and credit cards. They can issue electronic checking slip which is accepted all over and reduces your frequent visit to the Banks.

Online Banking Services are largely used by all the customers globally, as many payment alternatives available for transactions like Credit Cards, Wallets, Vouchers, Cheques, etc. As the Highest % are using the Online Banking and purchasing cashless, Our Radiant Pay is also doing payment ease for this customer, if they don’t have Credit& Debit cards with them.

Call to Join Radiant Pay as an Expert

I hope you got the complete Idea of how an Online Payment Solution provider is making our work of running a seamless and profitable ecommerce business, is converting our dreams into reality. They help to collect money, in a safe, fast, and easy manner, without troubling us a bit.

If you are looking for a quality Online Payment Service Provider, Radiant Pay is more than the Best choice. It is better to grow your business with all the other resources, and leave the Digital Online Payment to Radiant Pay for the extremely better and sure result of Rocket like growth in your ecommerce business. You can also visit www.radiantpay.com and

support@radiantpay.com