In this hard economic crisis time, a huge number of business owners are gearing toward online businesses. And why not? Starting an online business gives you many opportunities to grow business and at the same time one can expand the business at International level. Online business not only saves up the payment space but it can cut down the overhead startup cost of the business.

You also save up on insurance and utility costs. Many business owners are setting up the idea to establish their own system, and after some period this system will be entirely online based. If you set up an online based business-be it large-scale or small-scale, most of your services payments will be done through credit cards. If you do not start taking or accept card transactions, then you will lose a huge number of sales.

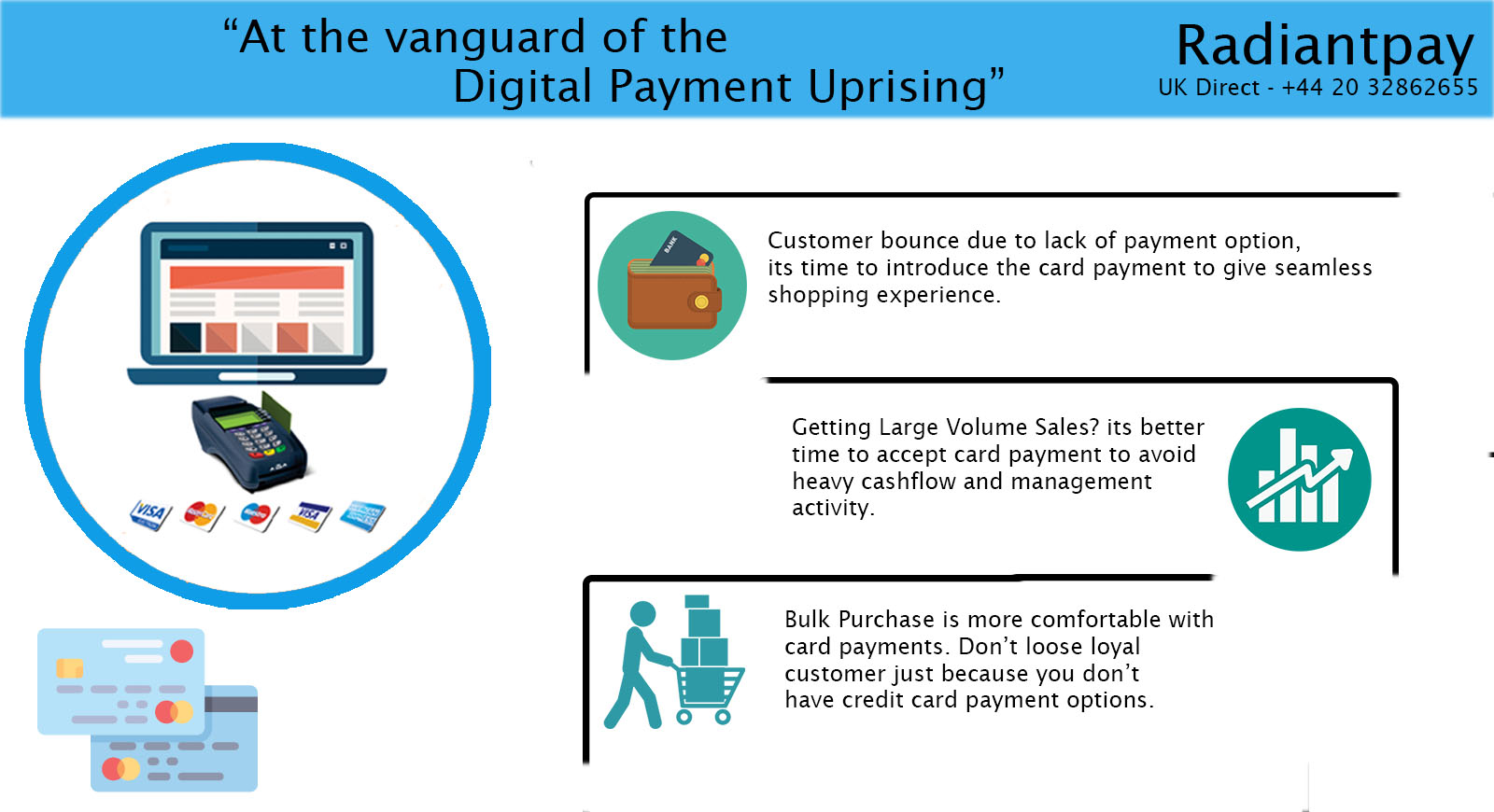

Nowadays, many customers are looking for online payment mode which is reliable and convenient, and if you do not accept the online payment method, they might move to another website, which will offer the best mode of payment. A recent study indicates that the businesses who do not accept credit card payments have lost sales upto 400% higher than the one who owns the online payment mode.

\Setting up the system to accept card payment is so easy and convenient. For the set up, you have two options. You could apply for the Traditional merchant account. With this option, you will have to pay the set up fees and an extra charge every month.

The second option is to go for an online card processing company, which gives you the best card processing services, without charging any setup fees. Finding a reliable card processing company for a business is just a step ahead, you will find a huge number of companies online or service providers that give you best rates. At first, you will not be able to foresee how many transactions you will undertake per month. Therefore, avert going for the lower transaction fee-higher monthly payment. Until you are certain of the number of transactions in a month, you should go for the higher transaction-lower monthly pay fee. With the latter option, you will pay for each transaction and about $10 per month.

With the proper research and scrutiny of the online card processing providers an online merchant account will ensure that you sign up with the right company. One should [pay attention to the extra cost to any company that offers bonuses and application fees. You should opt for a company that will be able to alert you, through your phone or mail, of any credit card payments and transactions. It will cost you somewhat less if you accept a $70 credit card payment than creating, printing and mailing an invoice to the client.

Whether you are establishing a small online business or extending your already successful business, accepting card payment will definitely decrease debts. This will increase the overall cash flow hence increasing profits for the business. Constantly making high profits will ensure the prosperity of your business.

All in all, you should be familiar with the overall credit card processing procedure. It is essential to know what your business needs or requires and how you can make it happen. Accepting cash payment is one of the tough task for online businesses, hence, considering online payment method with credit card processing is best, where everything is handled and seen by banks which gives you less stress, and you can concentrate on sales and expanding the business.