What are the latest payment services?

Have you ever heard of Money Order?

That sounds quite out of date service, isn’t it?

But that was considered very latest in the 1980s especially in India via Indian Post or ` Daak’. It was a way to send money from one place to another post, for any business or household requirement in those days, and it served well too, now it’s used as an E-money order in Indian post. That is electronic.

But that also is not flawless and fast. Before that money notes, coins, value, and barter systems, I don’t want to take you to the Victorian era, but we are looking at how the process of transaction evolved.

Any payment service today is challenged by its latest version, on and on. We can have the detailed on other Payment services which are most relevant and most excepted online.

Why do we always want changes in the Payment Processes?

That is a million-dollar question. Because there is a need, there are inventions. In every sector and services, if we are not happy to the brim, we expect something better fast and secure. Some payment system

- Cash- More than 15 years back the buyers were giving paper money notes, although someone can steal them, they could be misplaced, robbed, fraud notes were there as our enemy, then also buyers and clients were carrying the bags and packets. For the only reason to buy something and have happiness and comforts.

- Banking and Credit Card, with the increase in online purchase, the purchasing power of the common man increased many folds. Due to this reason, many banks came up with Credit Card and Debit card system. The dominance of the cash payment decreased, this is almost the start of a digital transaction system.

Credit Card revolutionized the payment system, to purchase something, you were just a swipe away and that’s all, of course, you have to pay the bank, in 45 to 50 days span, otherwise, you pay the heavy fines and interests.

Today credit cards are filled in wallets and are used vastly in a retail shop or any online ecommerce site they fastened the economy, enhanced the online business, and gave liberty to every man for instant purchase.

It has some cones also regarding the other person using with some details, many online fishing are in practice to illegally eat your balance, and some other security measures came into existence. Which gave a path to more advanced payment solutions like net banking.

Online Bank Transections also is known as Net Banking. This fund transaction was considered as safer as more or less operated within the bank themselves.

- Online banking, is electronically operated on secure websites institutions over the Internet. It is started by creating a Username and password, from home itself, and need to register your mobile number and Email ID.

This payment process is used to send Funds like in Same Bank Transfer, NEFT/RTGS/IMPS in other banks, Bill Payments, etc. It helped to perform good transaction facilities from anywhere, with more credentials online. All these services have certain limitations also, regarding their settlement timings, which gave the path to more innovative ways.

- Accept Online Payments, there is almost 2 trillion dollars a year transection, which is online, and it’s only going to get bigger. If you are an ecommerce buyer or purchaser you are recommended, or bound to do online payments on websites and portals, it’s inevitable.

Two basic need to accept the online Payment online you need a Merchant account and a frontend Payment Gateway service, which are integrated, to do seamless transactions online for your Ecommerce website.

Payment gateways are some software that works as an instant mediator to forward the secret banking data with issuer banks and gains approval for clearance, for a proper transection, very fast.

As these payment online services are not free and charges around 1.5% to 3.5% per transaction + any monthly charge, depending on which service are you taking for customer satisfaction?

There are certain norms to do online business and Payment services, as they retain the power to approve or decline your request to restrict the fraudulent and cybercrimes.

How you can get the best Payment Solutions?

Do you run an ecommerce store or ecommerce service, then which of the above-mentioned methods are most relevant in today’s scenario? Let me know at our site support@radiantpay.com.

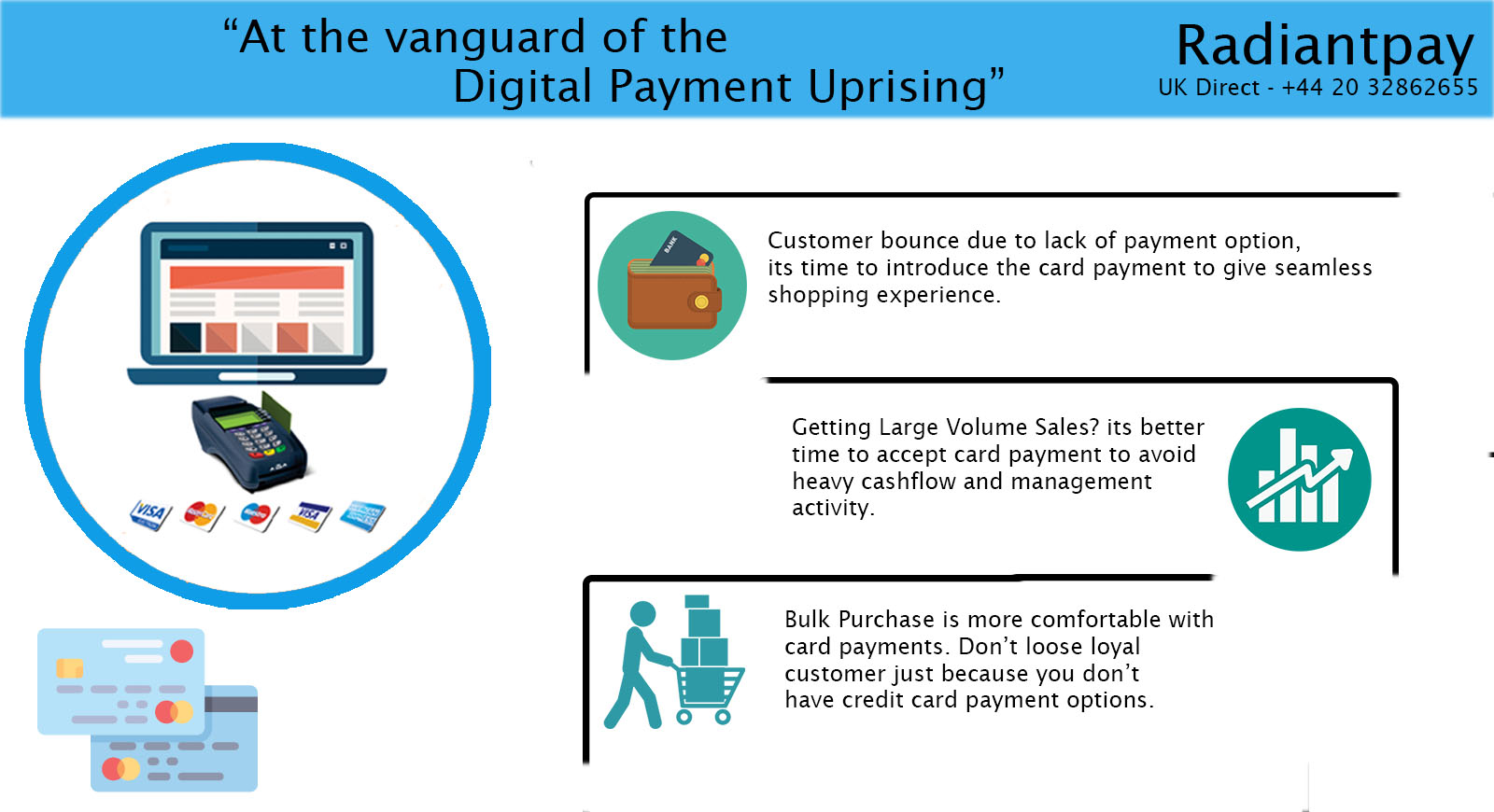

If you are eager to make your online ecommerce business a real success, then don’t compromise, and go for the best Online Payment Solutions like the Radiant Pay situated in London.

Our expert team of technical advisers is giving the best Payment solutions with many payment services like- Offshore Merchant Accounts, Credit Cards Processing Merchant accounts Services, High-Risk processing, ACH, and Check to process, and online Banking Payments.

The possibility of ecommerce business doing well depends more on the ways to collect money. Money safely collected is your business in hand, and that is profit, which can be accomplished by a smart Online Payment Solution, none other than the Radiant Pay.