Do you want to do online business?

But what if you find your eCommerce business on the High-Risk side?

What is high-risk and in who’s eyes?

The online business market is on a real boost. Every small and large business are running here and there to start an online business. In the process when they find their business is a high–risk, considered in the online arena. That sends a real jolt in the nerve.

But what is the difference if it is high risk or low?

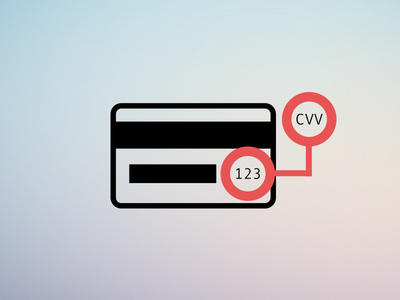

It makes a lot of difference, as high-risk business payment acceptance by offshore banks, and payment gateways treat them with more strict chargebacks and more fee per transaction.

We have to classify our online business as high-risk or low-risk in terms of banking and merchant services. By knowing that you can pinpoint your type of need, and search for a merchant account that can serve your type of business appropriately.

What are the types of High-risk online businesses and their distinctions to be so?

The factors responsible to label your online business as High-risk not only depend on what you sell online. It also includes the fraud potential, the chargeback possibility, huge amount transection, and history of account losses.

If you are Online with running Tobacco, casino, the adult industry and goods, traveling agency, online gaming, gambling, alcohol and liquor, Glassware, Guns and firearms, Narcotic drugs, debt collection, and many more are listed as the high-Risk businesses by many banks and oversea Merchant accounts.

Radiant Pay can provide solutions

As Radiant Pay can access your request to open a merchant account for your High-risk online business, we are tackling successful transaction bailout for some controversial money transections, in the overseas banks.

Radiant pay is a leading payment service provider for online payment based in London. Which is a good experienced for catering to the High-risk enterprises with low-cost payment solutions, which are otherwise always targeted by many banks with high chargeback and transection fee, for being High-risk type.

We can handle, or our experts are capable of handling any tricky situation and can guide your fund a smooth pass to your merchant account, which is possible due to our strong foot and goodwill network in many overseas Banks and Banks in European Union countries.

Radiant pay is the war-horse to rally upon, for your beneficial ride, no matter you do a high-risk online business.