Introduction

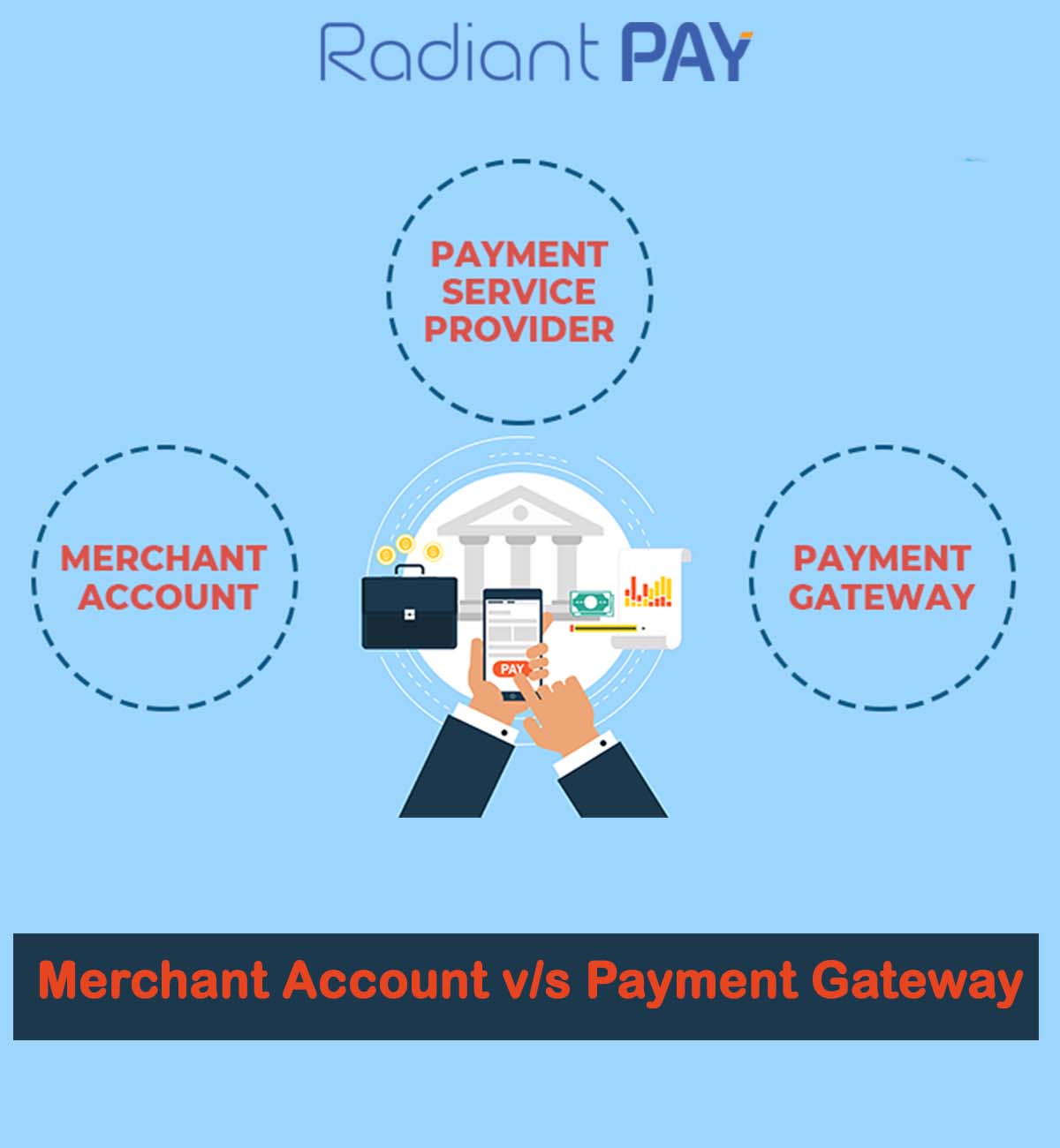

If you’re an online business owner, you know that accepting payments is essential for success. But what are the different ways to accept payments online? And what’s the difference between a merchant account and a payment gateway?

In this blog post, we’ll explain the key differences between merchant accounts and payment gateways. We’ll also discuss which option is right for your business.

What is a Merchant Account?

A merchant account is a bank account that’s specifically designed for processing payments. It allows businesses to accept credit cards, debit cards, and other forms of electronic payments. Merchant accounts are typically provided by banks or third-party payment processors.

When you open a merchant account, you’ll be assigned a unique merchant identification number (MID). This number is used to identify your business when processing payments. You’ll also need to obtain a payment processor, which is a company that facilitates the transfer of funds between your customers’ banks and your merchant account.

What is a Payment Gateway?

A payment gateway is a software application that facilitates the secure transmission of payment information between a customer’s computer and a merchant’s merchant account. Payment gateways also handle the authorization and settlement of payments.

When a customer makes a purchase from your online store, their payment information is sent to the payment gateway. The payment gateway then encrypts the payment information and sends it to your merchant account. Your merchant account then authorizes the payment and sends the funds to your business bank account.

The Difference Between Merchant Accounts and Payment Gateways

So, what’s the difference between a merchant account and a payment gateway?

- Merchant accounts store payment information and facilitate transactions.

- Payment gateways facilitate the secure transmission of payment information.

In order to accept payments online, businesses need both a merchant account and a payment gateway. The merchant account provides the secure storage of payment information, while the payment gateway facilitates the actual transmission of payment information.

Which Option is Right for Your Business?

The best option for your business will depend on your specific needs. If you need a high volume of transactions or need to accept a variety of payment types, then a merchant account may be the best option for you. However, if you’re just starting out or don’t need a high volume of transactions, then a payment gateway may be a more cost-effective option.

Conclusion

Merchant accounts and payment gateways are both essential for businesses that want to accept payments online. The best option for your business will depend on your specific needs.

If you’re still not sure which option is right for you, then you can consult with a payment processing expert. They can help you assess your needs and recommend the best solution for your business.