Radiant Pay is the global leading payment processing service provider, for business of all industries. It helps merchants to serve their customers as soon as possible by completing the financial transaction instantly. Radiant Pay offers the merchant and its customers flexibility of payment processing through secure and innovative services who have e-commerce presence or want to take it online. The service permits an online buyer to make a financial transaction at its comfort and within a few clicks.

Expert team at Radiant Pay, will help you with tailored Merchant Account Solutions of all types to all high-risk or low risk businesses, which will facilitate you to accept and process the electronic payment card transactions

Benefits of having a Merchant Account:

The travel industry is deemed to be a booming industry accounting for worldwide GDP and employing millions of people. As travelers around the globe, these days opt for online payment methods mainly using cards and other alternative payment processing methods.

We at Radiant Pay provide you with a beneficial, advanced, and transparent account. Here we have just the right payment processing solution to accelerate the success of your business.

- High-level security

With the reputation of credit and debit card scams in the travel industry, the need for security is satisfied with effective, safe, and reliable payment processing solutions for the travel business. With it, you can make sure that you and your customers both are protected from scams.

- Increased Trust

By having a trustworthy travel – merchant account you provide a safe and secure payment portal on your website. Money is an integral part of everyone’s lives, when customers experience the safety of the mechanism the trust is automatically elevated.

- Increased customer satisfaction

It gives ease and freedom to the customers in selecting the payment method among multiple options. Today’s customer demands freedom of making choices of when and how they want to spend their money. By catering to the demands you can increase customer satisfaction or delight them.

- Increased Sale and Reach

Today a customer can have full control over the travel plans. With the privilege of convenience provided by Google, he/she can simply search, compare and book flights, hotels. Here, the merchant account plays an important role by giving you (the business) to achieve this.

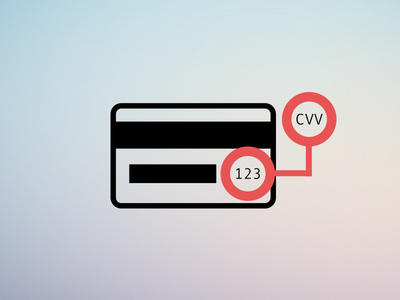

- Accept Cards

Using plastic money has become the new normal. The merchant account benefits by accepting credit cards and debit cards. It reduces the resistance of the payment transaction.

If you are new in the industry or looking forward to excellence and have reached here, you are at the right place. Radiant Pay is here to help you skyrocket your business success by helping you build an online merchant account setup.